- Credit tightened after the Housing Crash of 2008.

- Mortgage programs have varying mortgage requirements.

- Mortgage Lenders often have tighter credit score requirements.

Just How Tight are Mortgage Credit Score Requirements?

How is your credit score? If you are shopping for a mortgage then your credit score matters. With the demise of the subprime market after the housing crash in 2007-2008 followed by the Great Recession, credit became tighter.

Lenders tightened their credit score requirements (overlays), usually much stricter than the program requirements. For example minimum credit score requirements for a FHA mortgage are just 500 if you have a loan-to-value ratio (LTV) 90% or less, and 580 for those with a LTV over 90%. A conventional Fannie Mae or Freddie Mac mortgage requires, in most cases, a FICO credit score of at least 620.

Get a Mortgage Quote

If you are looking for a refinance mortgage, or a home purchase mortgage, then get a quote from a Bills.com mortgage provider.

Historical Look: Credit Scores and Mortgages

The CFPB provides data that helps us get a long-term perspective of mortgage origination by credit score. They divide credit scores into five categories:

- Deep subprime (credit scores below 580)

- Subprime (credit scores of 580-619)

- Near-prime (credit scores of 620-659)

- Prime (credit scores of 660-719)

- Super-prime (credit scores of 720 or above)

According to the CFPB data for December 2017, 86% of the borrowers had a credit score over 660. Borrowers with credit scores under 620 comprised only 5% of the mortgage market.

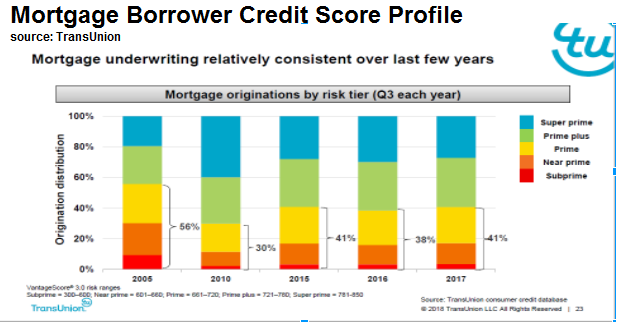

In order to help you get a historical perspective, check out the distribution of mortgage originations between 2005-2017. Not only did mortgage originations drop, but the amount of sub-prime lor less mortgage loans decreased from about 20% to 5%.

Another reliable source of information is provided by TransUnion. According to their 2017 Q4 Credit Report mortgage underwriting has remained fairly consistent. The prime plus and super prime (borrowers with a Vantage 3.0 credit score over 720) accounted for between 59% and 62% of all mortgage originations for Q3 between 2015 - 2017. This is compared to 44% in 2005 and 70% during the incredibly tight market of 2010.

Mortgage Credit Scores: They Vary by Loan Product and Purpose

Mortgage credit scores vary by loan products. FHA loan has more lenient minimum credit score requirements than FHFA (fannie Mae and Freddie Mac) loans. In addition, there is a big difference between purchase loans and refinance loans.

Ellie Mae, one of the largest providers of mortgage origination software publishes a monthly origination report. According to the Ellie Mae Origination Report January. 2017 (published in February 2018):

The average FICO score on all closed loans decreased one point to 721 in January 2018. 69 percent of all closed loans had FICO scores over 700. 70 percent of purchase loans had FICO scores over 700. 66 percent of refinances had FICO scores over 700.

For a more historical perspective, Ellie Mae’s data from July 2016 - January 2018 shows that the credit scores for closed mortgage loans has remained fairly stable.

Mortgage Credit Score Trends and the Mortgage Shopper

Credit scores in closed loans during 2017 were fairly stable and fairly high. While it is a bit easier to qualify for a refinance loan than a purchase loan it is very hard to qualify for a mortgage with a subprime FICO score.

Here are a few steps you can take to improve your credit score:

- Monitor your credit report and dispute negative incorrect information.

- Make all of your payments on time.

- Lower your credit utilization by paying down credit cards.

- Keep a mixture of types of credit.

Credit scores aren’t the only thing to take into consideration when shopping for a mortgage. In order to increase your chances to qualify for a purchase mortgage:

- Pay down your debt and keep your Debt-to-income ratio down.

- Save money for a down payment.

In addition, shop for a mortgage.

- If turned down, then ask the loan officer for the reasons you were denied.

- If you have a low credit score, then look for alternative mortgage loans, such as a non-qualified mortgage.

Is your Credit Good Enough?

Is your credit good enough to qualify for a mortgage? If so, get a quote from a Bills.com mortgage provider.