Credit Repair: Remove Errors & Improve Your Report

- You can remove inaccurate items from your credit report through a the dispute process.

- Accurate negative information remains for 7-10 years.

- Repair your credit using good financial habits.

- Start your FREE debt assessment

Correct & Improve Your Credit With Credit Repair

Buying a car or house? Renting an apartment? Looking for a job?

What do all of those actions have in common? Your credit score and credit history affect your ability to get a loan, rent an apartment, or sometimes even to get a job. A low credit score or the presence of a collection item on your report may prevent you from getting a loan, or cause you to pay higher interest rates.

Your credit score is based on your reported credit history, and what shows on your report is not necessarily correct. We all have read stories about wrong information appearing on credit reports due to confusion about Social Security numbers or names, as well as due to identity theft. Whatever the reason, it is upsetting to see inaccurate information on your credit report. If you see mistakes on your credit report, it is important for you to take the right steps to repair your credit.

To repair your credit, learn:

- Which items can be removed from a credit report

- How to remove an inaccurate item from a credit report

- How to improve your credit

Credit Repair: What Can Be Removed?

The Fair Credit Reporting Act (FCRA), a federal law, requires consumer credit reporting agencies to report accurate information. If you find any inaccuracies in your credit report, dispute the inaccurate derogatory account with the credit bureau reporting it.

The table breaks down your credit report into three categories:

| Type of Item | Can the Item be Removed | Comments |

|---|---|---|

| Inaccurate or incomplete items | Yes, through a dispute process | Includes items that have a mistaken identity due to social security, name or address mix-up, or identity theft. |

| Accurate negative items | According to the FTC, accurate information cannot legally be removed before the date of expiration, which is usually between 7-10 years from the original date of delinquency. | Dispute any items that remain on your report longer than is allowed by the FCRA. |

| Positive items | No need to remove. | Positive items help to build your credit score. |

FCRA 7-Year Rule

Federal law controls the behavior of credit reporting agencies. Under the FCRA an account in collection will appear on a consumer’s credit report for up to 7½ years (including the first period to determine delinquency, between 30-180 days). To determine when the credit reporting agencies should remove a derogatory account from your report, add 7 years to the date of first delinquency.

Subsequent activity, such as resolving the debt, is irrelevant to the seven-year rule. However, if the debt is a tax lien, that can appear for 7 years from the date of payment. A bankruptcy can appear for 10 years from the date of filing (15 U.S.C. §1681c). Delinquent federal student loans can be reported indefinitely, for as long as they are delinquent.

Credit Repair: How to Remove an Item From Your Credit Report

Now that you know what items you can remove, let’s look at how you can get those inaccurate items removed from your credit report. Here is what the FTC writes about credit repair:

“No one can legally remove accurate and timely negative information from a credit report. The law allows you to ask for an investigation of information in your file that you dispute as inaccurate or incomplete. There is no charge for this. Some people hire a company to investigate on their behalf, but anything a credit repair clinic can do legally, you can do for yourself at little or no cost.”

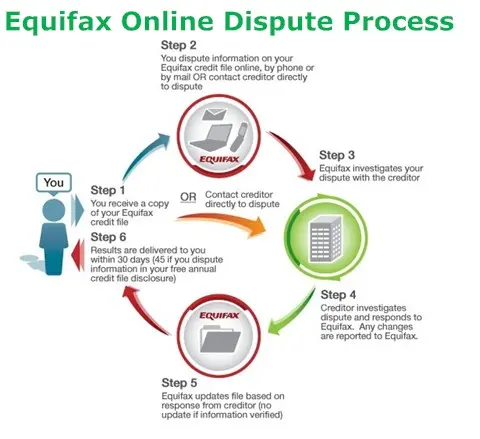

Bills.com has detailed information about disputing a credit report. Here is a brief explanation of the credit repair process:

1. Get a credit report: You are entitled to one free credit report each year from each of the major consumer credit reporting agencies (CRAs) — Experian, Equifax, and TransUnion. You can receive them through the Web site AnnualCreditReport.com. In general, it is a good idea to stagger the reports, getting one every four months, so you can view a free report three times a year. However, if you see incorrect items on one report, you should consider taking out all of the reports at once.

2. Look for errors: Pay special attention to personal details, including your name, social security, and address. Go over all the reported credit accounts and verify that they belong to you. (If you are not sure, then read about verifying a debt).

3. Dispute any error(s) with the CRA reporting the error(s): Each CRA is independent of the others and may report different information about you. Send a letter or use the CRA’s online process to dispute any inaccurate item(s). The three major CRAs offer the ability to dispute an inaccuracy online:

| Equifax | Experian | TransUnion |

|---|---|---|

| 800-685-1111 | 888-397-3742 | 800-916-8800 |

| Equifax.com | Experian.com | TransUnion.com |

| File a credit dispute online at Equifax | File a credit dispute online at Experian | File a credit dispute online at TransUnion |

Image courtesy of Equifax.com

4. Dispute the Errors with the Creditor: Send a dispute letter to the creditor, with copies of any supporting documents.

Professional Service? Be Careful

Both the FTC and the Consumer Financial Protection Bureau (CFPB) both recommend using a do-it-yourself approach to credit repair. They warn of credit repair scams and consumers paying unnecessary fees. Some people do use professional credit repair companies. Bills.com does not recommend using a professional service. If you make this choice, make sure you pay for services you need. A professional credit repair company cannot perform miracles. There is no guarantee any derogatory but accurate information can be removed. Check out the Bills.com article Lexington Law Review - MUST READ THESE FACTS! about a credit repair service, including both positive and negative reader comments.

Credit Repair: Improve Your Credit

Although some people do dispute accurate negative items, that information can be deleted only with permission of the creditor. Sometimes a dispute letter is sent to the creditor, who does not respond, and therefore the item is deleted from the credit report. However, if the creditor reports the item to the CRA, the item will be reinstated. According to the FTC fact sheet, “Consumer reporting companies must investigate the items you question within 30 days — unless they consider your dispute frivolous”.

Some credit repair services promise to get rid of all kinds of information. However, accurate information that is removed due to an untimely answer from the creditor can reappear.

The best way to deal with repairing and improving your credit is to deal with your debt problems. That means taking the following steps:

1. Analyze your debt problems: Make a personal budget and know how much you make and how much you spend. Work on controlling your expenses. Make sure you have an accurate account of all your debts, including the amount, the interest rate, the servicer, the monthly payment, and the payment schedule.

Find a Debt Payoff Solution

Problems with debt? Try out Bills.com Debt Payoff Calculator to find a debt relief solution that fits your personal financial situation.

2. Pay off your delinquent accounts: Any collection items should be dealt with. There are different debt relief options, including loan consolidation, credit counseling, debt settlement and bankruptcy.

Get A Free Debt Relief Consultation

Contact one of Bills.com’s pre-screened debt providers for a free, no-hassle debt relief quote.

3. Maintain good financial practices: Use some of these techniques to improve your credit. including:

- Timely payments

- Lower credit utilization

- Avoid minimum payments

Disputing inaccurate items on your credit report can improve your credit profile. However, good financial habits are the best way to create and maintain a good credit history.

Get rid of your debt faster with debt relief

Take the first step towards a debt-free life with personalized debt reduction strategies.

Choose your debt amount

Or speak to a debt consultant 844-731-0836

3 Comments

Hello everyone. Are you looking intod hacking services to improve your credit score? Be warned, these hackers here are all scammers! Don't fall for it. The one who tried to rip me off is iNotablespy . org at gmail . com. Do NOT give them a dime!!!

Warning: stay away from "hackers" who say they can boost your score. They are rip-offs and scammers. I was lied to by a hacking firm known as GHOSTVIRUS.

Do not fall for scams promising overnight credit repair like the rip-off artist that tried to hose me. He said I could repair all my credit in two weeks. Stay away from scammer whose email starts hackengineexpert@.