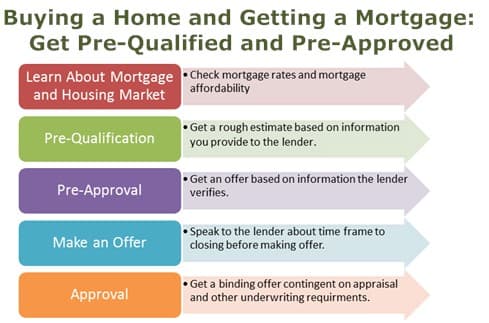

Pre-Approval & Pre-Qualify for a Mortgage Loan

- Learn about mortgage rates and mortgage qualification requirements.

- Get a rough estimate and pre-qualified for your mortgage loan.

- Before making an offer to purchase a home get a pre-approval based on lender verification of your information.

How to Get a Mortgage Pre-Approval

Buying a home, taking a mortgage or even refinancing your mortgage is not a one-step process. To ensure your success, take time to learn about the housing market and the mortgage market. Getting pre-qualified and pre-approved helps you search for the ideal home that fits your budget.

You cannot close any deal unless you have the required financing set up. Unless you are paying in cash (which very few can do), you need to make sure that you can obtain an affordable mortgage. Here are five steps you should take to get a mortgage approval:

- Learn about mortgages and what it takes to qualify for a mortgage loan.

- Learn about mortgage rates and mortgage affordability.

- Get pre-qualified.

- Get a mortgage pre-approval

- Make a full application and get a mortgage approval.

As you get further in the purchase process, you want to make sure lenders review your request based on updated, accurate, and verified facts.

Learn about the differences between a pre-qualification and a pre-approval.

Editor’s Note

If you want to refinance your home, then learn about how to qualify for a refinance loan and then skip to the pre-approval stage.

Pre-Qualified: Getting Your Toes Wet

Start by preparing yourself to qualify for a mortgage by building a strong credit score, save money for a downpayment (or build equity in your property), and creating a solid budget and income cash flow. Once you do your basic research, you are ready to test the water and get pre-qualified.

Quick Tip #1

Check out Bills.com mortgage rate table to find out today’s rates.

A pre-qualification approval is a loan offer that includes the amount of loan, the interest rate and the monthly payment. The pre-qualification approval is based on information you provide to the lender about your credit score, income, debt, and downpayment. The lender does not verify the information and the pre-qualification approval is not a commitment or a real loan offer. The pre-qualification approval does not include all the closing costs and loan requirements.

Quick Tip #2:

To get that rough estimate of how much you can qualify for check out today’s mortgage rates and use Bills.com mortgage affordability calculator.

By learning on your own how much mortgage you can afford or getting a pre-qualification approval, you can get your toes wet and start to narrow down the price range of homes to look for.

Pre-Approval: Taking a Plunge

A pre-approval, on the other hand, is a more involved process because the lender makes a tentative commitment to provide you with mortgage funding.

To get pre-approved:

- You need to provide the lender with documentation of your income, assets, and debts.

- The lender pulls your credit report and receives at least one credit report and score.

- The lender verifies your information.

If pre-approved, the lender provides you with a letter of commitment, telling you how much money they would be willing to loan you for the home purchase. Sellers and real estate agents will take you much more seriously when they see that you are pre-approved for mortgage funding.

However, keep in mind that even a pre-approval is not a guarantee that you will be approved for a mortgage loan. The final loan process includes a property appraisal, title search, and review of your income and credit information. The pre-approval is not a binding commitment and you can obtain a mortgage from a different lender.

Pre-Approval Helps you Make an Offer

Before you shop for a home and/or a mortgage learn about mortgage rates and loan qualification requirements. Building a strong credit score, a strong equity position and a low debt to income ratio are three important factors.

If you are refinancing then go straight to a pre-approval, providing as much information as needed to receive a quote fitted to your situation.

If you want to purchase, then the following two-step approach is useful:

- Get a pre-qualification approval to help narrow down price range of homes to look for.

- Get a pre-approval so you can make an offer. Speak with the different lenders to make sure that they can close a loan in the required time it takes to buy a home. Naturally, having the pre-approval makes the final application process shorter once you find the right house.

Quick Tip #3

get a mortgage quote from a bills.com mortgage provider.