- Prepare your budget and finances so you can qualify for a mortgage.

- Make sure your DTI, Credit Score and Downpayment are sufficient.

- Get best mortgage rates by being prepared to qualify.

Qualify for a Home Mortgage: Getting Yourself Prepared

You can save time and money by preparing yourself to qualify for a mortgage loan. Take time to learn about mortgage terms and what you need to qualify for the best mortgage rates. Even a small difference in your interest rate can save you thousands of dollars.

Depending on your credit score, your downpayment and your income you will qualify for different types of loans. Refinance loans require a certain amount of equity, although there are currently programs for underwater borrowers. The mortgage market is dynamic, so you need to shop around and check the rates and terms close to the time you are purchasing or refinancing.

To qualify for a mortgage loan, make sure you understand how to prepare yourself in these three areas:

- Your Income and Ability to Pay

- Your Credit and Willingness to Pay

- Your Equity and Downpayment

Qualifying for a Mortgage — Your Income and Ability to Pay

Lenders want to know that you have the financial resources to pay back the loan. A general rule of thumb is that the mortgage should not be more than three times your annual income.

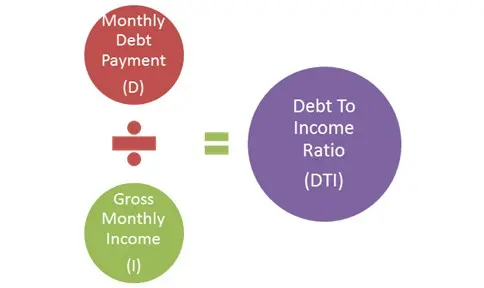

However, lenders have a more exact method to determine if you qualify for a mortgage loan, namely your debt-to-income ratio (DTI). Here is how to calculate your DTI:

Here is an explanation of the different terms:

| Term | Components |

|---|---|

| Monthly Debt Payments | Housing expenses include: • Mortgage Principal and Interest • Property Tax • Mortgage Insurance • HOA or other monthly costs Other Monthly debt includes: • Credit card • Auto Loan • Student Loan • Installment loans and credit • Court-ordered payments |

| Monthly Gross Income | Stable verifiable income from: • Wages or self-employment • Investments • Pensions • Alimony or court-ordered payments |

| Debt-to-Income (DTI) | To qualify for the best rates your DTI should be about 36%. • Conventional lenders restrict your overall DTI to ~45%. • FHA loans have a 43% DTI limit and a 31% limit based on housing expenses. |

Remember, a mortgage loan is a long-term commitment. Make sure you have a stable source of income to make your payments. You should also have an emergency fund and savings to guarantee that you can make the payments on time.

If your DTI is too high, then work on decreasing your debt load. Don’t rush into buying a house and taking a mortgage you cannot afford.

Avoid High Monthly Debt Payments

If you have a high DTI, then you should look for ways to deal with your debt. Avoiding the minimum payment cycle on your credit card debts is one important step. Use the Bills.com Debt Coach to get other ideas of how to deal with debt problems.

Qualifying for a Mortgage — Your Creditworthiness and Willingness to Pay

Qualifying for a mortgage loan means you can show the lender that you have a track-record of paying back your loans. The most common measurement is your FICO credit score, based on your credit history.

Your credit score is based on five main criteria. Ask yourself the following questions:

- Do you make your payments on time?

- Do you keep your credit balances below 30%?

- Do you have a long credit history?

- Do you have lots of new credit?

- Do you have a mix of different types of credit?

Your credit score is very important in determining if you qualify for a loan and if so what interest rate you can receive. I recommend that you take the time to read more about the FICO score and tips on how to improve your credit score. If you have incorrect information on your report then learn how to do a credit repair.

Quick Tip #2

Remember to monitor your credit report and your credit score. You can get a free report from each of the big credit bureaus for free once a year from AnnualCreditReport.com. You can also get. a free report, for a trial period, with your credit score.

If your credit report has collection items, then you will not qualify for most loans, without first dealing with your debt. It is difficult to qualify with bad credit. If you have bankruptcies or foreclosures on your credit report, then you will need to wait between 2-4 years to qualify for most loans.

Qualifying for a Mortgage Loan: Your Equity or Downpayment

To qualify for a mortgage loan you will need to show that you have equity invested in the property. If it is a purchase loan, then the lender will check your downpayment. If it is a refinance loan then the lender will check to see how much your house is worth after paying off the loan.

Lenders refer to your equity position in the property as loan-to-value ratio (LTV), which is calculated by dividing the amount you owe by the value of the house. For a purchase loan, lenders use the lower value between the purchase price and the appraised value. For example, your LTV is 70% under these conditions:

| Calculating LTV | |

|---|---|

| Property Value | $300,000 |

| Loan | $210,000 |

| 210,000/300,000 = .70 | |

| LTV | 70% |

Different loans have different qualifying LTVs. Here are a few examples, as of September 2012:

- Conventional loans: LTV up to 80%

- Conventional loans with Mortgage Insurance: LTV up to 90%-95%

- FHA loan: Up to 96.5% (with mandatory Mortgage Insurance)

- VA loans: Up to 100% financing for eligible VA borrowers only.

- HARP refinance loans: Unlimited LTV for eligible Fannie Mae/Freddie Mac borrowers.

Quick Tip #3

Not sure how much you can afford? Check out Bills.com mortgage affordability calculator to see the maximum amount you can qualify for based on your DTI and LTV.

Summary: Qualifying for a Mortgage

Bills.com has articles to help you dig deeper into the mortgage qualifying process. By preparing your finances in advance you can save money by qualifying for a less expensive mortgage.

Remember to follow the basic rules for mortgage qualification:

- Make a budget and know your expenses. Keep your DTI down.

- Save money for a bigger downpayment. A LTV under 80% will save you the cost of mortgage insurance.

- Monitor your credit score and credit report. Make all your payments on time, keep a number of different accounts active and don’t max out on your credit cards. (Even better, pay them off at the end of each month).

Quick Tip #4

read about mortgage rates and find today’s rates customized to your situation. feeling ready to get a your mortgage? get a mortgage quote from one of bills.com mortgage providers.