Record Keeping & Personal Finance

Get rid of your debt faster with debt relief

Choose your debt amount

Or speak to a debt consultant 844-731-0836

- 4 min read

- Good records can help you improve your financial situation.

- With online banking, shopping, and investments keep records digitally.

- Tax records are special -- keep tax records for 7 years.

- Start your FREE debt assessment

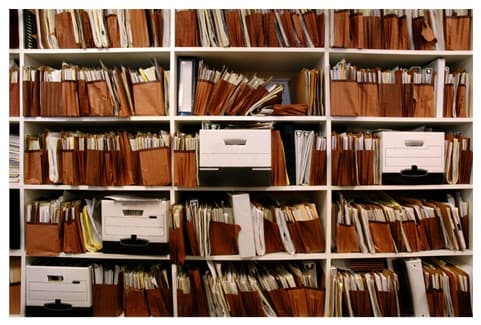

Keeping Records: What Records Should I Keep & For How Long?

In today’s digital world, with a choice between paper and paperless, you must decide:

- What records to keep

- How long to keep the records

- What manner to keep the records

Let’s review the reasons why keeping records is important to you.

Record Keeping & Your Financial Situation

Here are three areas to improve your financial situation: Personal budget, tax obligations, and debt management.

Personal Budget

By creating a personal budget, you will get a better understanding of your cash flow. You will learn about your expenses, debts and investments, you will be able to make better long-term plans for savings, investments, and purchases.

Tax Obligations

If you have tax debt, then having good records is important. Good record keeping will help you file on time, and make any changes necessary. You may need to amend old returns or prove that you are eligible for a hardship program.

Debt Management

If you have debts, and who doesn’t, then good record keeping will help you find information about your loans and creditors. You can monitor how much you owe, and how much your debt is costing you. If you have wish to refinance, consolidate, or deal with problem debt, then you can easily discover what you have and who to turn to.

If you're struggling with debt and need unbiased, no-nonsense advice, use the Debt Coach to help you find the right solution.

How to Keep Records: Paper or Digital

You can either keep records in paper form or save as files on your computer. Many bills and statements come in computer files. You can save them in different formats and hardware available. You can scan and save important documents on your computer. Remember to back up your documents and files.

Among activities available today on the internet are online banking, online investments, online tax returns, and online shopping. If you use online banking or other online Web sites, then you can easily save documents on your computer.

Moving over from paper to digital often creates a short-term overlap. Once you get organized, you will find it easier to decide which documents to keep in a duplicate format. Once you become proficient in using the computer and creating back-ups, then you will be able to wean yourself from the paper copies.

Sometimes it is hard to find records or documents. However, many vital records are retrievable. In the digital world, it is easy to retrieve many records from various companies. This may come at a minor financial expense, and use it only as a last resort option.

What Records to Keep and How Long to Keep Records

Mail, junk mail, bills, documents. Sometimes it seems like we are drowning in a sea of paperwork. The digital world has not increased the amount of non-paper records we get, but also the amount of paper we get.

One key are is tax records. A business will have other needs than a private person. Whenever considering how long to keep any document, always keep in mind whither it will have a tax implication and save it accordingly.

The major personal financial areas that you will need to keep your records are: Personal budget, Big Purchases, Tax, Investment/Insurance, and Banking. Some non-financial areas include personal family documents and medical records.

Personal Budget

- What records to keep: Keep store receipts, ATM receipts, utility, telephone and other bills. You will also need to keep monthly banking and credit card statements.

- How long to keep records: Keep the records for at least three months. Review that all the purchases are correctly entered in your bank and credit card statements. Review your monthly bills. If there is a discrepancy, then keep the document until you resolve the problem.

Tax Records

- What records to keep: Keep your tax records along with supporting evidence such as W-2 and 1099 forms. Also, keep any documents that relate to itemized deductions.

- How long to keep records: The general rule is 7 years. See the Bills.com article about tips for keeping good tax records.

If you struggling with IRS tax debt, get a no-cost, no obligation analysis of your options from one of Bills.com’s pre-screened tax specialists.

Banking

- What records to keep: Keep your monthly and yearly statements. Check with your professional tax advisor which documents are necessary for your tax records.

- How long to keep records: Keep the monthly statements for at least the whole tax year. File yearly statements separately and save as needed for tax purposes.

Investments and Insurance

- What records to keep: Keep monthly statements and yearly statements. In addition, keep any purchase statements until they are closed with a sale statement and reported on a 1099.

- How long to keep records: Keep the monthly bank statements for at least one whole tax year. File yearly statements separately. Keep insurance policies for as long as they are active.

Good records help reduce stress and solve problems that arise. Follow these guidelines, and remember to back-up your data if you decide to digitize your personal files.

Get rid of your debt faster with debt relief

Take the first step towards a debt-free life with personalized debt reduction strategies.

Choose your debt amount

Or speak to a debt consultant 844-731-0836