- You have three main options for paying a credit card bill: By check, online transfers, or autopsy.

- You could also pay your bill by money order or in person with cash.

- Pay at least the minimum on time every month.

- Paying more than the minimum amount can save you money and help your credit score.

- Start your FREE debt assessment

Table of Contents

It’s important to pay all your bills on time, but credit card bills require special attention.

Credit card bills are unique in that you can choose how much you pay. How you handle that choice can make a huge impact on your finances.

Handling your credit card payments the wrong way can cost you. It can hurt your credit score, cost you more in interest payments and get you hit with late payment fees.

On the bright side, making your credit card payments the right way could help you build a strong credit score. It could also save you thousands of dollars in fees and interest charges.

This article will tell you what you need to know to make the right choices about your credit card payments. Topics include:

- What is your credit card bill?

- Ways to pay your credit card bill

- How much of your credit card bill should you pay?

- How to make late payments on your credit card bill

- 5 credit card payment tips

What Is Your Credit Card Bill?

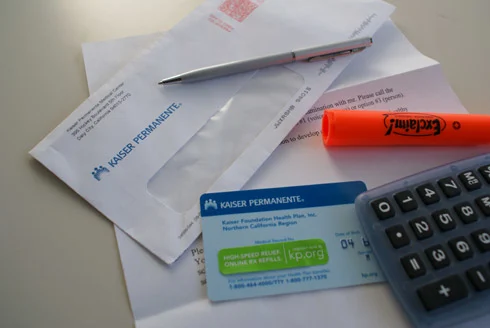

Your credit card bill may be a paper statement you get in the mail, or an electronic notification you can view online. Either way, it contains a lot of important information. Below are some of the key parts of a credit card bill:

Credit card statement

You should receive a credit card statement once a month. Check it right away because some of the information is time-sensitive.

A credit card statement tells you what you owe, but that’s just the beginning. You generally have choices about how much you pay, and your statement will let you see the range of those choices.

As described below, a credit card statement also tells you important things about how you’re using your account. How you use this information can save (or cost!) you money.

Previous balance

Your credit card statement should list your previous balance. This shows how much you owed at the beginning of the current statement cycle.

That’s a good place to start in reviewing your current statement. This allows you to see whether any payments you’ve made since were properly credited.

Recent transactions

These should include any purchases you’ve made since the last statement, plus your payments, fees and interest charges.

Review these transactions line by line, and make sure your payments were received and credited to your account. Also, look for unexpected fees.

Finally, note any transactions you don’t recognize. These may simply be errors, but they could also be signs of fraudulent activity. Double-check these items and report anything suspicious immediately to your credit card issuer.

Statement balance

Your statement balance is what you owe on the last day of your billing cycle. If your billing cycle ends on September 21 and it’s now October 3, your statement balance reflects what you owe on September 21 and does not include charges or payments made after that. This balance is very important because you'll pay interest on any part of this you don’t pay off by the due date.

Current balance

Your current balance shows the total amount you owe. It should equal your previous balance plus all charges, fees, and interest, and minus payments and credits. Your current balance is different from your statement balance. That number only counts charges and payments posted during your last billing cycle, while the current balance includes charges and credits posted after the end of the billing cycle.

It’s important to understand the difference because you have to pay your statement balance to avoid interest charges. Items charged after your statement date will be picked up in the next statement and are in their grace period until then.

You should compare your current balance to your credit limit to avoid maxing out or going over-limit. Using a high percentage of your credit limit can drag down your credit score.

Minimum payment due

This shows the least amount you need to pay in this billing cycle. If you don’t pay at least that amount by the due date, you’ll be charged a late payment fee and probably reported as “late” to the credit bureaus.

You’ll probably notice that the minimum payment due is a lot less than the current balance you owe. You’ll also see if you pay online that the payment amount defaults to the minimum. That makes the payment more affordable, but it is a bit of a trap.

According to a study by the Brookings Institute, most U.S. credit card companies calculate the minimum payment based on 1% of the balance or a minimum dollar amount of $25 to $35. Making payments at that rate, it could take you decades to pay off your credit card balance. If you continue to make purchases on the card, you’re likely to see your balance grow rather than shrink over time.

The longer it takes you to pay off a balance, the more interest you’ll pay. So, try to pay more than the minimum payment on each credit card statement. The faster you pay off your balance, the less interest you’ll pay.

Due date

The due date tells you when you must pay or be charged a late fee. Note that you might be charged a late fee if you’re a day overdue, but you won’t get dinged for being late on your credit report unless you’re more than 30 days late. So pay as soon as you can.

Mailed payments fall under a US law called the mailbox rule that says your payment is considered made on the date that you mail it. So most companies count the postmark date, not the date they receive the payment, when determining whether a payment is late. That said, mailed payments can get lost. To be safe with mailed payments, send them early and check to make sure they were received and credited.

Ways to Pay Your Credit Card Bill

As noted above, how you pay your credit card bill can make a difference in whether or not your payment is received on time.

You have three main options for paying a credit card bill:

- By check. You can mail a check to your credit card issuer as payment.

- Online transfers. You can direct your bank or credit union to make an electronic payment to your credit card company. This is faster than sending a check, and gives you immediate proof of the payment.

- Autopay. You may be able to set your account up to have payments automatically billed directly to your bank or credit union. While this is efficient, keep in mind that the amount due on your credit card can vary from month to month. That may make it more difficult to make sure you always have enough of an account balance to cover the payment.

Under some circumstances, you could also pay your bill by money order or in person with cash at a local bank branch. As a practical matter paying by check or online transfer is generally cheaper and more efficient.

How Much of Your Credit Card Bill Should You Pay?

You should pay at least the minimum amount every month to avoid late fees and dings on your credit report.

If you can, you pay more than the minimum each month. Ideally, you should pay off your entire balance. You don’t pay interest if you avoid carrying a balance. It also helps your credit score and keeps you from spending more than you earn.

How to Make Late Payments on Your Credit Card Bill

If you miss a payment date, the first thing to do is to make the payment as soon as possible. An online transfer is likely to be the fastest way of getting this done. Also, it will let you know as soon as the payment has been received.

Missing a due date will probably cause you to be charged a late fee. However, if you make the payment soon after the due date you should contact the credit card company to see if you can get the late fee waived. If you otherwise have a good payment history for the card, they might be willing to give you a break. And remember that if you pay within 30 days of your due date your credit score won’t be harmed. .

5 Credit Card Payment Tips

Below are five credit card payment tips that can save you money and keep your credit score in good shape.

1. Get to know your billing cycle

Under the terms of the 2009 CARD Act, the due date for each bill must be on the same date of each month. If that date falls on a weekend or holiday, then the due date will be the next business day following the regular due date.

Get familiar with when your statements typically come out, and when the due dates are. Doing this will help make sure you don’t accidentally overlook a statement. It will also aid you in making sure you have enough money available to pay the bill.

2. Online payment reduces the chance of late fees

By law, you are supposed to have 21 days between the statement date and the payment due date. However, if you don’t get to the statement right away, that window can close quickly.

It’s much easier to avoid missed payments if you set up automatic payments to your credit card issuers. You get an email reminder, you click a link and choose your payment amount. Nice and easy.

3. Pay more than the minimum each month

Credit card companies don’t set their minimum payments low to be nice to you. They want to stretch out your repayment over a longer period so you pay more interest.

You can beat them at that game by always paying more than the minimum and trying to avoid carrying a balance. If you pay your balance off in full and on time each month, you can avoid interest charges altogether.

4. If you use multiple cards, prioritize payment amounts according to interest rates

If you can’t pay all your balances off in full each month, start by making sure you make the minimum payment on each card. That way you’ll avoid late fees and bad marks on your credit record.

If you have enough money to pay more than the minimum required amount on all your cards, put any extra payment towards the card with the highest interest rate. Reducing that balance will save you the most in interest charges.

5. Watch your credit utilization

Credit utilization is the percentage of your credit limit that is currently in use. For example, if you have a credit limit of $4,000 and your current balance is $2,000, your credit utilization for that card is 50%.

Credit utilization is measured for each card you have and overall credit. A high credit utilization percentage can hurt your credit score. So, on each statement, compare your balance to your credit limit. Whenever possible, try to get your credit utilization down below 30%, and lower is better.

Get rid of your debt faster with debt relief

Take the first step towards a debt-free life with personalized debt reduction strategies.

Choose your debt amount

Or speak to a debt consultant 844-731-0836

How do I avoid credit card late payment fees?

All you have to do to avoid credit card late payment fees is pay at least the minimum required amount by the due date.

How much time do I have to pay my credit card bill to avoid interest charges?

By law, you have 21 days from when a statement is issued to when payment is due.

How long will it take to pay off a $2,000 credit card bill at 18% interest if I pay only the minimum amount due each month?

Formulas to calculate minimum payment amounts vary among credit card issuers. A typical formula is the greater of 1% of your balance or $35. With that formula, it would take nearly 11 years to pay off a $2,000 credit card bill at 18% interest. And that’s assuming there are no fees or other charges on the card.

Recommended Reads