Table of Contents

- Bills Bottom Line

- Verify your medical bills before you negotiate

- Fix errors before moving forward

- Financial assistance for medical debt

- How to negotiate medical bills with your provider

- Negotiating medical debt in collections

- Know Your Rights With Medical Debt Collectors

- Get Medical Bill Agreements in Writing

- Bills Action Plan

Bills Bottom Line

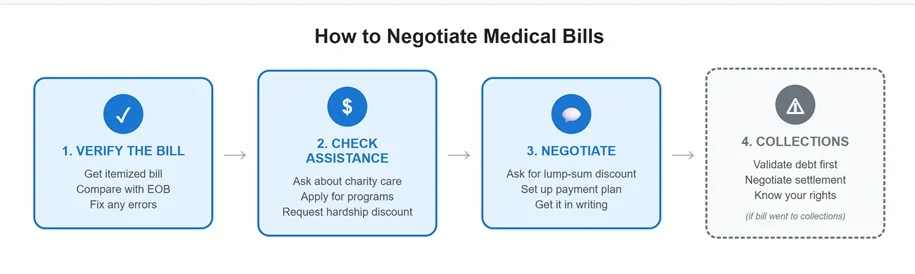

Medical bills are negotiable—but only after you've verified they're accurate. Request an itemized bill, compare it with your insurance Explanation of Benefits (EOB), and fix any errors before you talk money. Then ask about financial assistance, discounts for paying in full, or a payment plan you can actually afford. Get every agreement in writing before you pay.

You open your mailbox and there it is: a medical bill for $4,200. The procedure was months ago. You assumed insurance would handle most of it. Now you're staring at a balance that doesn't fit anywhere in your budget.

Here's what the billing department won't tell you: that number isn't necessarily final. You can negotiate medical debt —and hospitals routinely reduce balances, waive portions for patients who qualify, and set up interest-free payment plans. But they don't volunteer it. You have to ask, and you have to ask the right way.

Verify your medical bills before you negotiate

Negotiation means nothing if the bill is wrong. Medical billing errors happen more often than most people realize—duplicate charges, incorrect codes, services billed but never provided. Before you negotiate a single dollar, make sure you're not paying for someone else's mistake.

Request an itemized bill

That summary statement in your mailbox only shows the total. Call the billing department and ask for an itemized bill—a line-by-line breakdown showing every charge, the date of service, and the billing codes used. Look for red flags: charges you don't remember, duplicate entries, or room charges that don't match your stay.

Compare it with your EOB

Your insurance company sends an Explanation of Benefits after processing a claim. It shows what the provider billed, what insurance paid, and what you owe. Line up the itemized bill with the EOB and look for mismatches: insurance adjustments that weren't applied, claims that were denied without your knowledge, or out-of-network charges for care you received at an in-network facility.

Fix errors before moving forward

If something doesn't match, call the billing department. Common issues include upcoding (billing for a pricier procedure than what was done), unbundling (charging separately for services that should be billed together), and wrong diagnosis codes that caused insurance to deny coverage. If the error affected how insurance processed the claim, ask the provider to resubmit it with corrections.

Financial assistance for medical debt

Before you negotiate a discount, find out if you qualify for programs that could reduce or eliminate the bill entirely. Many people skip this step—or assume they won't qualify—when they actually could.

Charity Care Programs

Nonprofit hospitals are required by federal law to offer financial assistance. Many for-profit hospitals do too. Eligibility typically depends on your income relative to the federal poverty level—some hospitals cover patients earning up to 200%, 300%, or even 400% of the FPL. A family of four earning around $62,000 in 2024 would be at roughly 200% of the poverty level. Ask the hospital's financial counselor for an application and find out what documents you'll need (usually pay stubs, tax returns, and proof of household size).

Hardship discounts

If you earn too much for charity care but the bill is still unmanageable, ask about hardship discounts. Some hospitals offer sliding-scale reductions even for patients who don't meet full assistance criteria. Be direct: explain that you want to pay but the balance exceeds what you can afford, and ask if there's any flexibility.

How to negotiate medical bills with your provider

Once you've verified the bill and checked for assistance programs, it's time to negotiate. The billing department has more flexibility than you might think—but you have to ask.

Ask for a Lump-Sum Discount

Providers often reduce balances for patients who can pay the full amount immediately. It saves them the hassle of chasing payments over time. If you have savings you can use, ask: "What discount would you offer if I pay the full balance today?" Discounts typically range from 10% to 30%, though some providers go higher for large bills.

Set up a payment plan

If paying in full isn't realistic, ask about payment plans. Many hospitals offer interest-free arrangements that spread the balance over 12, 24, or 36 months. This is usually better than putting the bill on a credit card, where interest adds up fast. One warning: only agree to payments you can afford. Defaulting on a payment plan can send your account to collections anyway.

What to realistically expect

There are no guarantees. Outcomes depend on the provider, the size of the bill, your financial situation, and whether you're offering to pay now or over time. That said, lump-sum discounts of 10–30% are common, interest-free payment plans are widely available, and some providers will combine a modest discount with a payment plan. The key is asking clearly and being honest about what you can afford.

Sample Script for negotiating medical bills

"Hi, I'm calling about account number [X]. I've reviewed my itemized bill and my EOB, and the balance looks accurate—but it's more than I can afford. I'd like to resolve this. Do you offer discounts for paying in full, or could we set up a payment plan? I can afford [specific amount] per month, or [lump sum] today if there's a discount."

Negotiating medical debt in collections

Once a medical bill goes to a collection agency, the rules change. You're no longer dealing with the hospital—you're dealing with a third party whose only goal is to collect. The approach is different, but you still have leverage.

Validate the debt first

Before you pay anything, request debt validation in writing. Under federal law (the FDCPA), collectors must verify the debt if you ask within 30 days of their first contact. This confirms the debt is legitimate, the amount is correct, and it actually belongs to you. Don't negotiate until you've seen proof.

How medical debt negotiations differ in collections

Negotiating with a collector isn't the same as negotiating with a hospital. Collectors can't offer charity care or fix billing errors—you'd have to go back to the original provider for that. But collectors are often more willing to accept a lump-sum settlement for less than the full balance, especially on older debts. Settlements in the 30–60% range aren't uncommon, though results vary. Start with a lower offer and negotiate from there.

| Provider | Collector |

|---|---|

| May offer charity care or assistance | No assistance programs |

| Can fix billing errors | Cannot fix errors—go to provider |

| Discounts: typically 10–30% | Settlements: often 30–60% |

| Don't pay based on this alone | Pay only after both parties sign |

Know Your Rights With Medical Debt Collectors

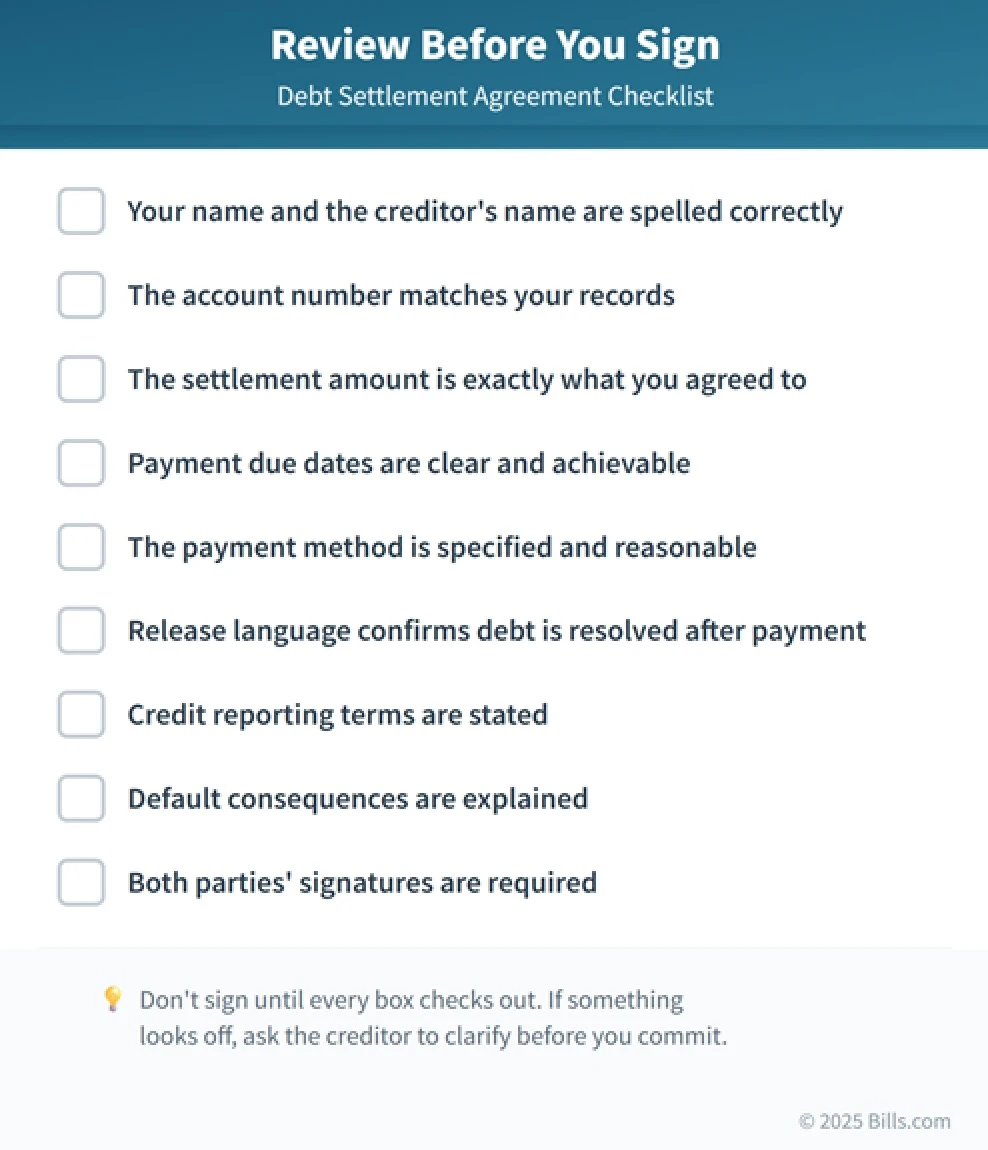

Collectors can't call before 8 a.m. or after 9 p.m., can't threaten or harass you, and must stop contacting you if you request it in writing. If a collector violates these rules, you can file a complaint with the CFPB. Never give a collector direct access to your bank account, and always get settlement agreements in writing before you pay—including confirmation that the remaining balance will be forgiven.

Get Medical Bill Agreements in Writing

This is non-negotiable. Before you send any payment—whether to a provider or a collector—get written confirmation of the medical debt forgiveness agreement. A verbal promise means very little if there's a dispute later. Their written confirmation should include the original balance, the agreed final amount, any discount applied, payment terms, and a statement that the account will be considered paid in full. For collection settlements, make sure the confirmation states that the remaining balance is forgiven. Keep all your records—bills, EOBs, agreements, payment receipts, and notes from phone calls—for at least seven years. Even better, scan everything in and store the documents in an email folder indefinitely.

Bills Action Plan

That $4,200 bill—or whatever number you're staring at—doesn't have to wreck your budget. Here's how to take control:

- Request an itemized bill and compare it with your insurance EOB.

- Dispute errors with the billing department before negotiating.

- Ask about financial assistance or charity care—especially at nonprofit hospitals.

- Negotiate a lump-sum discount or payment plan you can realistically afford.

- Get it in writing before you pay—final balance, terms, and paid-in-full confirmation.

- If it's in collections, validate the debt first, then negotiate a settlement.

Get rid of your debt faster with debt relief

Take the first step towards a debt-free life with personalized debt reduction strategies.

Choose your debt amount

Or speak to a debt consultant 844-731-0836

Will negotiating medical bills hurt my credit?

Negotiating itself doesn't affect your credit. But if the bill goes to collections, that’s likely to show up on your credit report. Medical debt under $500 and paid medical collections are now generally excluded from credit reports, but larger unpaid balances may still appear. The best protection is negotiating before it reaches collections.

What if I can't afford even a reduced medical bill?

If negotiation still leaves you with an unmanageable balance, ask again about charity care or hardship programs—eligibility requirements vary, and it's worth a second look. You could also speak with a bankruptcy attorney about your legal options. Avoid putting large medical bills on credit cards if possible; the interest makes things worse.

Should I hire someone to negotiate my medical debt?

For very large or complex bills, professional advocates can help—but they typically charge a fee or percentage of savings. For most bills, you can handle negotiation yourself using the steps above. Try on your own first; you can always bring in help later if needed.

Recommended Reads

10 Comments

Recent my wife had to visit a local ER due to severe abdominal pains which were found to be a miscarriage from a 3 month pregnancy. We then had to travel to another hospital where her ob/gyn could perform a D&C. I am a young high school teacher with very bad high deductible insurance and my wife is unemployed due to the recession. We have about $1,500 in a HSA, and a little cash in our savings, but fear our medical bills are going to be outrageous due to going to two different hospitals and with all of the tests, anesthesia, surgery, etc. We would like to negotiate a lower bill, but we are new to this. Should we wait until we get the bill after its been applied towards our deductible or be proactive and call the hospitals ASAP? Should we argue what should be or is a fair price of these procedures in other markets? Aside from always being courteous and polite, what are a few things we should really do regarding these in coming bills from the hospitals? Any and all help would be great.

I love your idea of comparing the prices for services with market prices. It would be great if hospitals would publish the prices for common procedures so that people could compare. Alas, I know of no reliable source for that information.

Perhaps you can check with your elected state representative, to see if his or her office can guide you.

Readers, I welcome your constructive suggestions for Jan.